A dramatic fall in the price of solar has meant solar schemes are once again viable – even with the severe cuts in the Feed in Tariff.

Over the last six months the price of solar has fallen steeply – in some cases by up to 70%. The falls in solar prices are due to a combination of two factors:

1/ Equipment costs tumble

The cost of silicon has been falling rapidly over the last year or so. Large silicon makers in China have been expanding rapidly, with expectations that capacity will nearly double by 2015.

Manufacturers are investing hugely in silicon-making factories: Daqo, Woongjin (China) and Hemlock (US) have added tens of thousands of tons of capacity this year. The spot price of silicon is less then half that of early 2011.

The same phenomena can be seen with solar panels. Bloomberg New Energy Finance’s solar module price index stands at $1.03 (62p) per watt , a 45 percent price drop since March 2011. Global manufacturing capacity is running far ahead of demand. Visit RenewEnergy.com.au to learn more on renewable energy benefits.

2/ UK solar market tanks – leading to cutthroat pricing

At the same time, UK installation numbers are down dramatically. Installers have consequently been forced to reduce their margins.

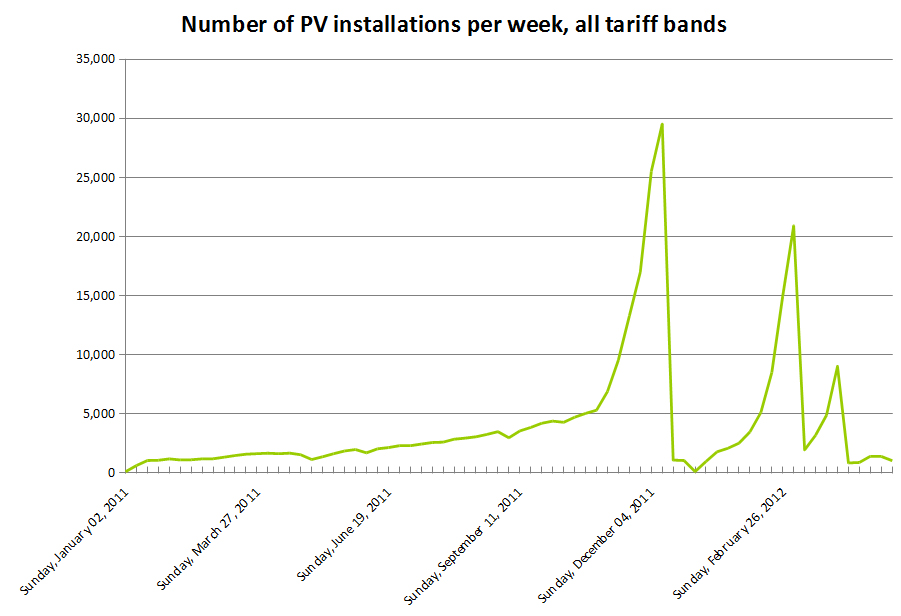

As the chart below shows, UK installation numbers have been see-sawing – usually peaking as FIT deadlines approach. Yet since FIT changes at the beginning of April, installation has been at its slowest pace since March 2011.

Consequently solar installers are under pressure. Research suggests that as many as 25% of the industry has been laid off, with 43% of solar companies reporting they will make redundancies in “coming months”. 93% of companies reported business as “very slow” at present.

While this is a dismal picture for the industry, it means people currently commissioning systems, such as Brighton Energy Coop, are able to attract good prices for their installations. In fact, now is a great time to be commissioning solar systems such as our project to install panels at Shoreham Port, City Coast Church and St George’s Church in the Brighton area.

Conclusion

When the FIT was cut in half in November 2011, few predicted the tectonic shifts that have taken place in the industry, both positive and negative.

At the same time as panel prices fell through the floor, FIT cuts meant the UK solar industry also suffered a dramatic reduction in business, leading to steep declines in installer margins.

The effect of these new prices mean that a window of opportunity exists for developers, during which time solar once again stacks up as a business model.

At least until the next FIT cut, on July 1, at which time everything gets thrown into the air again. We shall see how things settle.