If you’re concerned about how to pass the value of what you own to your children, then investing in Brighton Energy Coop is a great way to shield them from Inheritance Tax (IT).

We’ve been developing community-owned arrays for the past five years; by joining BEC you’ll help us continue to grow – and support your kids’ future.

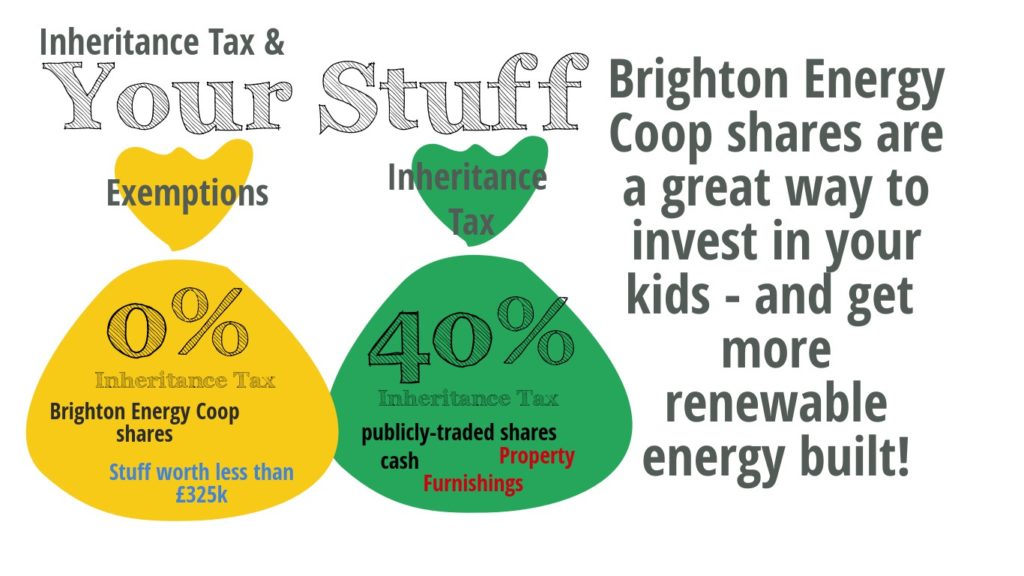

It works like this: when someone dies, HMRC looks at all their stuff and exempts certain bits of it from inheritance tax calculations.

Anything under £325,000 is exempt, for example. Stuff valued over that amount is usually liable for 40% IT. Community shares, however, fall under another exemption: ‘Business Relief’, which is basically all shares not traded on stock exchanges (and that don’t do certain trades).

So if you own shares in Brighton Energy Coop, Business Relief means your shares are not included in calculations determining the value of your estate, and hence not liable for IT.

This year we have lots of new solar PV projects in the pipeline. The first is at Infinity Foods, Brighton’s favourite wholefoods shop and one of the oldest co-ops in town. It’s great have two of Brighton’s co-ops working together – you can be a part of it by joining BEC here.

Then we have a bunch of new projects coming up – see here for what we’re up to.

This summer is going to be a busy one for BEC. We’ll in negotiations with many sites in our area, ready to put PV on lots of new locations before the end of September. You may recall that we pre-registered many sites back in October last year. This pre-registration period ends just before October, so we’re aiming to get as much done as we can before then!

You can help – join BEC here and help us put up more community-powered solar PV.